Accessing Pension-Grade Investments for Physicians, Dentists, and Business Owners

A Mount Columbia Private Wealth White Paper 2025 Edition

Executive Summary

For decades, Canada’s largest pension funds have put a significant portion of their money into infrastructure. These are the essential assets that keep our world running: data centers, energy pipelines, shipping networks, and transportation systems. The result? Strong, steady returns with less ups and downs than the stock market.

Until recently, these investments were off-limits to individual investors. The minimum investment was often $10 million or more. Today, through specialized wealth managers with the right relationships, successful professionals can access these same opportunities.

The numbers tell the story: infrastructure is a $100 trillion global opportunity. By 2040, the world will need $94 trillion in infrastructure investment, but only $79 trillion is expected to be funded publicly. That $15 trillion gap creates significant opportunity for private investors.

Why Infrastructure? Why Now?

When most people think of infrastructure, they picture toll roads and airports. But modern infrastructure is much broader. It includes the data centers that power your smartphone, the cold storage facilities that keep your groceries fresh, and the fiber networks that let you video call your family.

Here’s what makes these assets special: people need them regardless of what the economy is doing. A recession doesn’t make people stop using electricity. Stock market volatility doesn’t reduce internet usage. Demand for these services grows steadily, year after year.

| The Global Infrastructure Funding Gap $94 trillion needed by 2040 • Only $79 trillion expected $15 trillion gap = major opportunity for private investors Source: Global Infrastructure Outlook (2024) |

What Makes a Good Infrastructure Investment?

Not every asset called “infrastructure” is a good investment. Smart investors look for six key qualities:

1. Essential Services: The best infrastructure provides services people and businesses truly need—power, internet, shipping, water. When something is essential, demand stays strong even in tough economic times.

2. Hard to Compete With: Building a new power plant, pipeline, or data center takes enormous capital and often requires government permits. These barriers protect existing owners from new competition.

3. Predictable Cash Flow: Many infrastructure assets have long-term contracts (often 10-20 years) with reliable customers like governments and large corporations. You know what you’re going to earn.

4. Steady Demand: People don’t stop using electricity during a recession. Businesses still need to ship products. This stability means infrastructure investments don’t swing wildly with the stock market.

5. Built-in Inflation Protection: Many infrastructure contracts include automatic price increases tied to inflation. When prices rise, your investment income rises too.

6. Growing Demand Trends: The best infrastructure benefits from big, lasting trends: more data usage, more e-commerce shipping, cleaner energy. These aren’t fads—they’re reshaping our economy.

Better Returns, Less Volatility

Infrastructure sits in a sweet spot: I can provide returns similar to the long term return of the stock market, but with less risk.

Australian pension funds—pioneers in infrastructure investing since the 1990s—now put nearly 10% of their portfolios into infrastructure. Global institutions average about 3%, and that number is rising. They’ve discovered what individual investors are now learning: infrastructure can be the foundation of a stable, growing portfolio.

Three Areas Driving Infrastructure Growth

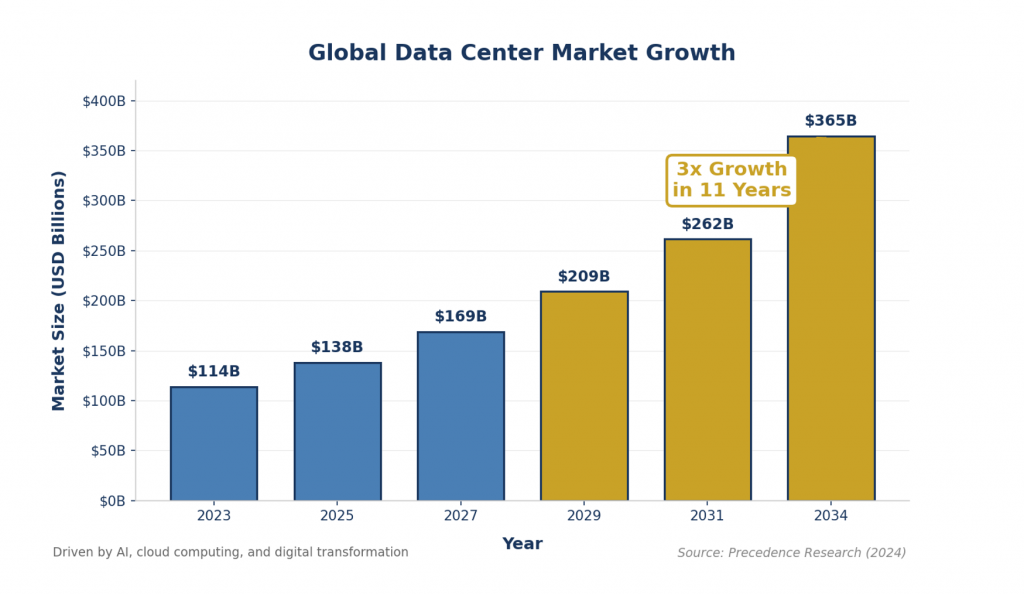

Digital Infrastructure: This is the physical backbone of the internet—data centers, cell towers, and fiber networks. Every time you stream a show, use cloud software, or ask an AI assistant a question, you’re using digital infrastructure. With AI growing rapidly, demand is exploding.

Transport and Logistics: This includes shipping ports, cold storage warehouses, and distribution networks. When you order something online and it arrives at your door, infrastructure made that happen. E-commerce growth and supply chain changes are driving major investment.

Energy Infrastructure: This covers both traditional energy (natural gas pipelines, power plants) and renewables (solar, wind, battery storage). The world needs $13 trillion in new energy infrastructure by 2050 to meet climate goals while keeping the lights on.

Why This Matters for Successful Professionals

As a successful professional or business owner, you should have every investment tool at your disposal. Unfortunately, most investors don’t.

The reality is that many advisors aren’t forward-thinking—or simply don’t have access to the full investment toolbox. They stick with what they know: public stocks, bonds, and mutual funds. These are fine tools, but they’re not the only tools. It’s like building a house with just a hammer when you could also have a drill, a saw, and a level.

Canada’s largest pension funds don’t limit themselves this way. They use private capital—investments in infrastructure, private equity, private credit, and real assets that aren’t available on public stock exchanges. These tools have helped pension funds deliver strong, consistent returns for millions of Canadian retirees.

The question is simple: if these investments are good enough for pension funds managing hundreds of billions of dollars, why shouldn’t you have access to them too?

Today, you can. The right wealth manager can open doors to institutional-quality infrastructure investments—the same managers, the same strategies, and the same opportunities that were previously reserved for the largest investors in the world. Click here to contact Shamez to put these strategies to work for you.

Disclaimer: This white paper is for informational purposes only and does not constitute investment advice or an offer to sell securities. Infrastructure investments involve risks including illiquidity, capital loss, and concentration. Past performance is not indicative of future results. Consult with qualified financial, legal, and tax advisors before making investment decisions. Data sources: Global Infrastructure Outlook (2024), Precedence Research (2024).