-

Pension-Grade Investing

for Healthcare Professionals

& Business OwnersYou built something exceptional. Now invest the way

Canada's largest pension funds do.

As Seen In

Built for Professionals Who've Built Something

Mount Columbia Private Wealth was founded on a simple premise: the professionals who build practices and businesses deserve the same investment access as Canada’s largest institutions.

Founder Shamez Kassam, CFA, MBA worked at Alberta Investment Management Corporation (AIMCo), managing alternative assets for one of Canada’s largest pension funds—over $180 billion in assets. He saw firsthand how institutional investors build wealth differently than what’s available to most Canadians.

Now he brings that institutional expertise to dentists, physicians, and entrepreneurs navigating significant wealth transitions.

Whether you’re a dentist managing a practice sale, a physician optimizing your professional corporation, or an entrepreneur after a liquidity event—we provide access to private equity, infrastructure, and private credit strategies that were once reserved for pension funds.

Our Assets

Most advisors offer the same balanced portfolio they give everyone. We’re different.

Through relationships built over 15+ years in pension and institutional investing, we provide access to the same private equity, infrastructure, and private credit managers that Canada’s largest pension funds use—investments that have historically strong risk-adjusted returns with lower correlation to public markets.

Private Capital

Private equity, private credit, and growth equity investments from top-tier global managers. These are the same strategies that pension funds and endowments use to generate strong risk adjusted returns — now accessible to qualified individual investors.

We focus on managers with proven track records, institutional-quality operations, and alignment of interests with investors.

Real Estate

Institutional-quality real estate investments across sectors: industrial, residential, retail, and specialized properties. Through our manager relationships, we access opportunities that offer both stable income and long-term appreciation potential.

Our focus is on high-quality assets with strong fundamentals.

Public Assets

A globally diversified foundation built on low-cost, tax-efficient ETFs—complemented by direct ownership in select high-quality companies with strong free cash flow and earnings growth.

We don't try to beat the market through trading. We build portfolios designed for long-term wealth accumulation and tax efficiency.

Infrastructure

The Old Playbook Isn't Working

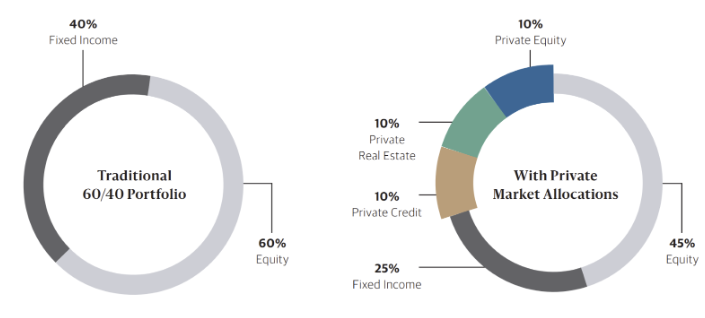

In 2022, stocks and bonds fell together—the worst year for the traditional 60/40 portfolio in decades. The diversification that investors counted on simply didn’t show up.

That’s why Canada’s largest pension funds—CPP, Ontario Teachers’ Pension Plan, AIMCo—typically allocate 40-50% of their portfolios to alternative investments. They learned long ago that private equity, infrastructure, and private credit offer diversification that bonds no longer reliably provide.

For decades, these investments were only available to institutions. That’s changed.

We build portfolios the way pension funds do: combining public market efficiency with private market return potential. It’s not about chasing returns—it’s about building resilient portfolios that perform across market cycles.

Our Services

Liquidity Event Planning

Selling a business or practice is often the largest financial event of your life. The decisions you make in the first 90 days—tax structuring, asset allocation, estate planning—compound for decades. We help professionals navigate this transition with a clear plan.

Professional Corporation Optimization

For physicians, dentists, and incorporated professionals, your corporate structure offers significant tax planning opportunities—but also complexity. We coordinate investment strategy with your accountant to maximize tax efficiency.

Private Markets Access

Access to pension-quality private equity, private credit, and infrastructure investments— including some of the same managers and strategies used by Canada's largest pension funds.

What Our customers say about us?

Trusted by thousands of users around the world. Our customers appreciate us for listening to their needs and updating our theme according to their needs.

Our Core Values

Discovery Meeting

Discovery Meeting

Who We Serve

We work with dental and medical professionals, entrepreneurs and incorporated business owners who’ve built something significant—and want their investments to reflect that same ambition.

At Mount Columbia Private Wealth, we specialize in serving professionals and entrepreneurs who require sophisticated financial strategies tailored to their unique needs. Our clients seek customized investment management with access to best of breed private, pension style investment opportunities. They want a trusted partner who understands the complexities of their financial lives and delivers expert guidance with clarity and confidence. We take a holistic approach, ensuring that every aspect of your financial picture is optimized, from investments and tax efficiency to risk management to business transitions and estate planning. Our team and value-added support network of professionals is dedicated to providing proactive, tailored solutions to help you achieve long-term financial security and success.

Mount Columbia Private Wealth is dedicated to helping you build, protect, and optimize your wealth with sophisticated, tax-efficient solutions tailored to your needs. We believe in proactive planning, transparent advice, and a client-first approach that ensures your wealth is managed with precision and care.

Contact us today to learn how we can help you achieve financial clarity and confidence.

Entrepreneurs and corporate executives face unique financial challenges, from tax-efficient wealth structuring to succession planning and liquidity management. As a business owner, your personal and professional finances are often deeply intertwined, requiring careful planning to optimize cash flow, minimize tax burdens, and ensure a smooth transition when exiting your business. Corporate executives, on the other hand, must navigate stock options, deferred compensation plans, and complex tax scenarios that can impact long-term wealth. Whether you’re preparing for a business exit, optimizing corporate investments, or ensuring financial security for your family, we provide tailored strategies to preserve and grow your wealth. Our expertise in business wealth management ensures you have the right strategies in place to maximize value, protect assets, and build a legacy that lasts for generations.

Doctors, Dentists, Optometrists, and Chiropractors dedicate their careers to helping others but often struggle to find the time to manage their finances effectively. High-earning medical professionals face unique financial challenges, such as optimizing their professional corporation structures, planning for retirement, and protecting their income against disability and liability risks. Many also have the opportunity to invest in private practice ownership, which introduces additional financial considerations like cash flow management, practice expansion, and succession planning.

With significant earnings potential, incorporation opportunities, and retirement planning complexities, we help doctors, dentists, and other healthcare professionals maximize their wealth through tax-efficient investment solutions, risk management strategies, and long-term planning. By aligning your investments, tax planning, and insurance needs with your career goals, we ensure that your wealth works as hard for you as you do for your patients.

Women investors have unique financial journeys, whether they are executives, business owners, or professionals managing career transitions, inheritance, or family wealth. Many women face different career paths, such as taking time off for family, navigating wage gaps, or managing significant wealth through divorce or widowhood. Women also tend to live longer than men, making long-term financial planning even more critical. We provide specialized financial strategies that align with their goals, ensuring long-term security, financial independence, and confidence in their investment decisions.

Our approach is built on education, transparency, and empowerment, helping women take control of their financial future while making informed decisions that align with their values and aspirations. Whether you’re building wealth, managing a significant life change, or planning for retirement, our expert advisors provide the guidance and support you need to achieve financial confidence.

With shorter career spans and significant earnings at a young age, professional athletes require strategic wealth management to sustain their lifestyle long after retirement from sports. Unlike traditional careers, where income grows steadily over decades, athletes often earn the majority of their wealth in a short period, requiring careful planning to ensure long-term stability. Many athletes also face unique financial challenges such as managing large endorsement deals, planning for contract negotiations, and dealing with complex international tax issues. We help athletes navigate contract earnings, tax planning, endorsement income, and long-term investment strategies to ensure financial security and lasting wealth. Our team works closely with athletes to build sustainable financial plans that focus on wealth preservation, smart investing, and lifestyle protection, ensuring that their financial success extends well beyond their playing years. Whether you’re an active athlete or transitioning into a post-career business venture, we provide tailored financial solutions to support your evolving needs.

FAQ

To start, fill out our contact form, and one of our advisors will reach out to you. We’ll schedule a consultation to understand your financial goals, discuss your investment preferences, and determine the best strategies for managing your assets.

Our Private Capital offerings typically require a minimum investment and are open to accredited investors. To get started, schedule a consultation with our team, and we will walk you through the available opportunities and assess your risk tolerance.

In managing Public Assets, our team conducts thorough market research and builds diversified portfolios that include a mix of stocks, bonds, and other publicly traded securities. We aim to balance risk and returns while keeping your financial goals in focus.

We specialize in working with healthcare professionals, entrepreneurs, and business owners—but we're not limited to these groups. Our clients share a common profile: they've built significant wealth through their careers or businesses and want pension-quality investment strategies rather than off-the-shelf solutions.

We typically work with clients who have $500,000 or more in investable assets. However, we're happy to have a discovery conversation regardless—particularly for professionals early in their careers who are building toward this threshold.

Three key differences. First, we provide access to high quality private markets investments (private equity, infrastructure, private credit). Second, our founder worked for one of Canada's largest pension funds—it's not a side offering for us, it's our core expertise. Third, we're independent—we're not incentivized to sell proprietary products.

Stability. Transparency. Trust.

In the News

- January 30, 2026

Accessing Pension-Grade Investments for Physicians, Dentists, and Business Owners A Mount Columbia Private Wealth White Paper 2025 Edition Executive Summary...

- January 30, 2026

For forty years, bonds were the bedrock of every balanced portfolio. Safe. Reliable. Boring in the best way. Then came...

- January 30, 2026

"The old order is not coming back. We should not mourn it. Nostalgia is not a strategy." When Prime Minister...