Why Infrastructure Investing is Attractive for Retirees

In a world of declining interest rates, investors (and especially retirees) are continually seeking opportunities that offer stable returns, income generation, and protection against volatility. Infrastructure investing has emerged as an attractive option for both institutional and individual investors for several compelling reasons.

1. Stable and Predictable Cash Flows

Infrastructure assets, such as toll roads, airports, utilities, and communication towers, typically generate stable and predictable cash flows. These assets often operate under long-term contracts or regulatory frameworks that provide a steady income stream, regardless of economic cycles. In a declining interest rate environment, these predictable cash flows become even more appealing as bond yields decrease and investors search for reliable income sources.

2. Inflation Protection

Many infrastructure investments have revenues that are directly linked to inflation through contractual agreements or regulatory mechanisms. For example, toll roads may have fee schedules that increase with inflation, and utility rates are often adjusted to reflect rising costs. This inflation linkage helps preserve the real value of returns, which is particularly important when interest rates decline and purchasing power becomes a concern.

3. Low Correlation with Other Asset Classes

Infrastructure investments tend to have a low correlation with traditional asset classes such as equities and bonds. This diversification benefit can help reduce portfolio volatility and enhance overall risk-adjusted returns. In a declining interest rate environment, where traditional fixed-income investments may offer lower yields, infrastructure’s resilience can provide a critical stabilizing factor in an investment portfolio.

4. Attractive Yield Opportunities

As interest rates fall, the yield on traditional fixed-income securities such as government and corporate bonds also declines. Infrastructure assets, however, often provide higher yields compared to these traditional options, making them an attractive alternative for income-focused investors.

5. Capital Appreciation Potential

Beyond income, infrastructure investments can offer capital appreciation potential. As interest rates decline, the value of income-generating assets tends to rise because their future cash flows become more attractive when discounted at lower rates. This dynamic can result in higher valuations for infrastructure assets, benefiting investors with both income and growth.

6. Alignment with Long-Term Trends

Infrastructure investments are well-aligned with long-term economic and societal trends, including urbanization, renewable energy transition, and the digital economy. These trends create a sustained demand for infrastructure development and investment, providing opportunities for growth even in a low-interest-rate environment.

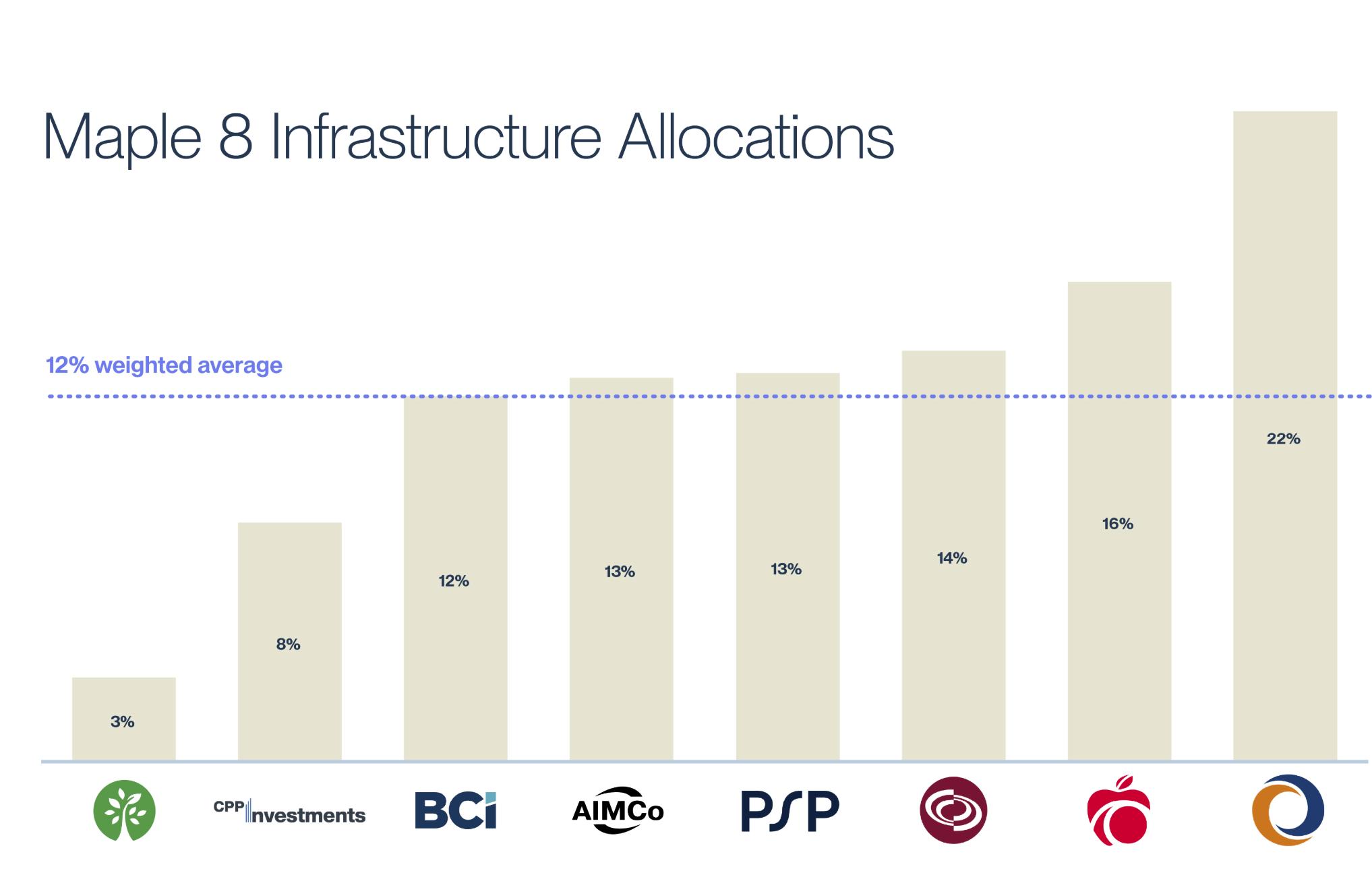

Allocation of Canadian Pension Plans to Infrastructure

The average infrastructure investment allocation for the largest Canadian pension plans is shown below. While these pension funds have an average of 12% allocated to infrastructure, most individual Canadian investors have minimal or no exposure.

Mount Columbia Private Wealth specializes in bringing such investments to individual Canadians – they are available and accessible.